Tenants: Are you ready to see your new office space?

By Beth Mattson-Teig | CCIM Institute | Original Source

Office tenants are tired of the same four walls. They want new space, new amenities, new creature comforts. They need a new vibe to attract new workers. So with a still-weak development pipeline, office owners and investors are stepping in to fill the gap, creating “like new” space options for today’s tenants.

A laundry list of factors – ranging from little or no new construction to a quest for higher yield in a very competitive investment market – is fueling a spike in renovation and repositioning projects in many metros. On one side, existing landlords are working to reposition properties to be more relevant in a market that is seeing dramatic shifts in what tenants want and need in amenities and features. These include a wish list of on-site bike lockers, rooftop decks, and energy efficient lighting.

On the other side, there has been a surge in opportunistic investing. Capitalization rate compression among stabilized properties has sparked interest in more challenging rehab projects as a means to achieve higher yields.

“We see areas in many submarkets that are ripe to modernize buildings, provide a new face-lift, and consider going to creative office,” says William A. Shopoff, CCIM, president and CEO of Shopoff Realty Investments LP in Irvine, Calif. The firm is pursuing value-add office projects as small as 75,000 square feet to more than 300,000 sf in California, Minnesota, and Texas.

“Generally speaking, there is probably more opportunity in secondary and tertiary markets,” Shopoff says. Those markets offer more attractive yields compared to most primary markets. Shopoff also targets cities with good employment growth and other economic drivers that support the healthy demand for repositioned space.

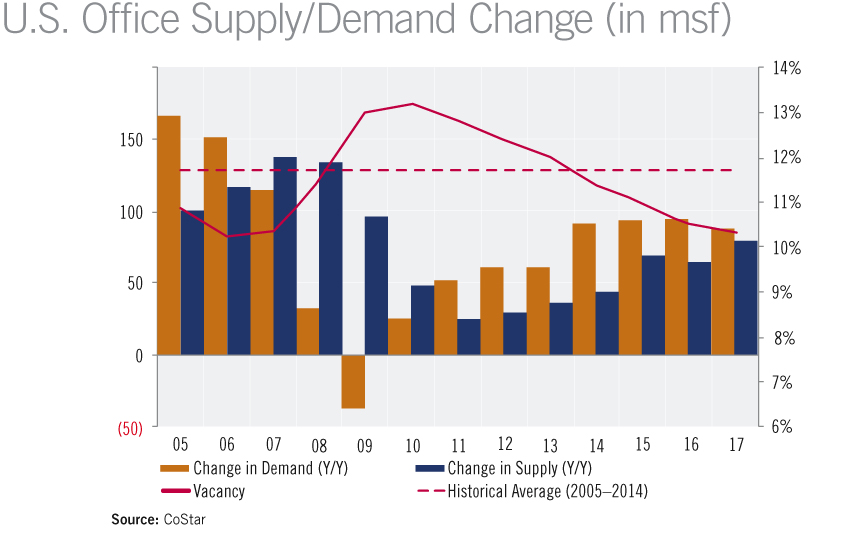

The newly renovated properties are providing tenants a welcome alternative in a market where construction is still at historically low levels. The U.S. office market saw a net gain of 68.8 million sf of space in 2015, which is well off pre-recession levels and still about 7 percent below the 10-year average of 73.7 msf in annual new inventory, according to CoStar.

Opportunities Persist

The distressed assets that emerged during and after the recession provided ample inventory for value-add investors. Despite the fact that the office market recovery is well under way, with vacancies improving to 11.0 percent at year-end, according to CoStar, there are still bargains in many metros.

TerraCap is one firm that has continued to accelerate its value-add investment strategy in the past five years with acquisitions throughout Florida. “We were able to go in and buy at the bottom of the market, and we continue to buy as the market is on the upswing,” says Albert S. Livingston, CCIM, director of asset management at TerraCap Management Corp. in Bonita Springs, Fla.

TerraCap’s strategy has been to acquire office properties at prices that are well below replacement cost, which allows them to put in significant capital to reposition a property and still have a relatively low cost basis to offer competitive rents. “We’re not afraid to buy empty buildings or buildings with single-digit occupancy, and go in do the work to make them competitive in that market and then lease them up,” says Livingston.

For example, TerraCap purchased a 160,000-sf office building in Maitland, Fla., last year that was 25 percent occupied. In addition to making updates, such as completely renovating the lobby and replacing the chillers, TerraCap increased the parking ratios to better serve the tenant demand for more densely populated buildings. At the time of purchase, the parking ratio was 3.5 stalls per 1,000 sf. TerraCap recently completed a new parking deck that now brings parking more in line with the current demand for 5/1,000 sf, and the firm is considering further expansion that would raise the level to 6/1,000 sf.

Arizona is also home to value-add office plays. “There are plenty of value-add opportunities still in the Phoenix and Tucson markets,” agrees George Larsen, CCIM, a principal at Larsen Baker LLC in Tucson. The firm focuses on value-add repositioning opportunities with a current portfolio of 2.5 million sf of office and retail properties in Tucson. Larsen Baker continues to find properties that are in transition or bank-owned at discounted prices.

In addition, there is ample demand on the tenant side from companies that are looking to upgrade and provide space that is appealing to workers. At the same time, many tenants are still price sensitive and reluctant to pay the higher costs necessary to support new construction. So, there are definitely opportunities to buy and rehab properties that fit into that bifurcated market, Larsen says.

For example, Larsen Baker bought a vacant, vandalized bank-owned office/flex space property near downtown Tucson for $650,000 or $16 psf that included 3.67 acres and nearly 40,000 sf in three buildings. The firm spent about four times the purchase price renovating the buildings to create the Madera Business Park, which is now 95 percent occupied, primarily by government offices.

Such projects generally deliver a good return. Larsen Baker prefers to buy properties at about $35 to $45 psf or 30 to 40 percent of replacement cost and spends another $60 to $70 psf on interior and exterior renovations. “If we can lease the renovated offices for $15 psf net rent, the investment value of the office building should increase to about $160 psf at stabilized occupancy,” Larsen says. That is still well below the cost of new construction, which in Tucson is about $200 psf, he says.

Pressure to Compete

Some existing landlords also are investing significant capital to both fill empty space and hold onto existing tenants. New York City is one market that is bucking the national construction trend. The city has seen increased competition coming from a wave of new multi-tenant office development. In particular, significant new development is occurring on the west side of Manhattan near Hudson Yards where Related Cos. is building a 3.3 msf office tower and Brookfield is underway with a new 2.3 msf building.

Even with gross rents trending upward of $100 psf in the new towers, those projects are enticing tenants away from older building stock, notably the Midtown area where the average age of a building is more than 50 years old, says Craig Evans, CCIM, senior managing director at Cushman & Wakefield in New York City.

Those aging buildings are struggling to meet the demands of today’s tenants, who want more amenities and the infrastructure that allows them to house more people in their space.

Landlords in the Midtown area are responding to that new competition by investing heavily in their buildings, Evans says. “It is a very robust market. The key thing when you are buying a fixer-upper in this market is to understand the functional obsolescence that can and cannot be cured,” he says. For example, New York City has specific requirements on life safety issues, which controls maximum occupancy on floors based on the size of stairwells and amount of people they can safely evacuate in the event of an emergency situation. Even if a landlord successfully completes a renovation to create more efficient space, the property could be hindered by existing building codes, he says.

Fighting for Talent

Today’s younger employees are attracted to work spaces that offer features such as shower facilities for employees who bike to work, outdoor terraces, and common area lounges. And given the war for talent among companies, “Landlords are investing in those somewhat expensive amenities to draw and retain tenants,” Evans says. “If they don’t do it, they will not be able to attract the quality of tenants that have anchored the buildings for the last 50 years. Those tenants will move to other locations,” he says.

The office market in Peoria, Ill., is a far cry from that of New York City. Peoria’s downtown is still struggling with significant office vacancies near 25 percent, compared to Manhattan’s rebound where vacancy has dropped below 9 percent. Yet Peoria’s building owners are facing many of the same challenges of trying to attract and retain tenants in a market where there has been a seismic shift in the type of space that appeals to today’s millennial workers.

Particularly for buildings where asking rents are very close, within 2 to 5 percent, the look and feel of a property can swing decisions, says Katie Kim, CCIM, CEO and director of the commercial division at Keller Williams/The Kim Group in Peoria. “With our vacancy the way it is, companies going into these spaces are demanding that landlords do those renovations in order to get their business,” says Kim.

Today’s tenants are feeling the pressure to attract workers. “They need their space to say we are an exciting company. We’re inviting. Come work for us. And they are putting a lot of that back on the landlord,” Kim says. For example, one tech start-up company that Kim recently worked with requested a slide between the second and first floor. The landlord complied.

Overcoming Challenges

As in many metros, Peoria’s landlords need to manage the cost of renovation versus current rental rates. “There is a gap with what the current rental market will bear, and the cost of construction does not allow for great returns for a lot of our office tenants,” Kim says.

However, as part of its efforts to entice companies back downtown, the city of Peoria is offering a number of economic incentives to promote development and redevelopment in targeted areas such as its River’s Edge District. Owners and developers can access federal and state historic tax credits and other tax credits specific to the River’s Edge Redevelopment Zone that include everything from job creation and building materials to property taxes on eligible projects.

“We have multiple incentives that the municipality has put in place to attract development downtown,” Kim says. That has really caused developers to take a second look to see if they can make projects financially viable in that area, she adds. Part of the challenge that remains in Peoria is educating building owners about what incentives are available and how they can utilize them to drive change, she says.

Another challenge is managing the risks inherent to these rehab projects. Owners and investors are taking a gamble in making a significant capital investment to reposition space, oftentimes in a market where there is still some excess space to absorb. Making sure the numbers work is another critical step.

“In Tucson, the risk is that the class B and C office market is not expanding. So, the office building you renovate has to be attractive enough to lure move-up office users. That involves a substantial slug of new cash for an exterior face-lift and interior renovations,” Larsen says.

Certainly, not every property is a good candidate for a rehab. Some are simply too functionally obsolete. Likewise, repositioning assets is not the best fit for every owner or investor. Those endeavors often require creativity, ingenuity, and some vision to take something that might be a little bit ugly, and make it more attractive and competitive in the marketplace, says Shopoff. “It is not just putting money in, it is putting money intelligently in the right place to deliver a good result in terms of yield and return on investment,” he says.

Development Pipeline Slow to Fill

by Beth Mattson-Teig

Given the pace of the office market recovery, it is no surprise that new ground-up development has been slow to return.

Although construction is on the rise, it is still low compared to historical norms. The estimated 68.9 million square feet of new space added in 2015 is up from the 44.0 msf delivered in 2014, according to CoStar. However, activity is below pre-recession levels where annual new supply surpassed 100 msf. In 2005 and 2006, for example, the net new supply grew by 100.1 and 117.4 msf respectively.

New construction remains lower for obvious reasons. Many metros are still dealing with elevated vacancies and tenants who are reluctant to pay the higher rents needed to support new construction. In addition, tenants are using space more efficiently and shrinking the amount of space they need per employee. “A lot of corporations have looked very hard at their space usage and have tried to decrease the number of square feet per worker,” says Hans Nordby, a managing director at CoStar Group in Boston. Although that trend may be starting to flatten in some metros, it has had an impact on the demand for space, he adds.

“The markets that saw construction first were those that had the most successful economies,” Nordby says. Four to five years ago, those cities that took the lead in emerging from the recession were energy and tech markets such as Houston and Seattle.

Development remains a ways off in the future for many metros, while others are seeing that turning point drawing closer. In Fresno, Calif., for example, lease rates have not reached levels that justify spec office building. However, the vacancy is dropping to the low single digits and lease rates are starting to climb, says Brett Visintainer, CCIM, a vice president, investment division at Newmark Grubb Pearson Commercial in Fresno, Calif. “It will only be a matter of time before Fresno starts seeing new development go up from developers that are looking to spec office buildings,” he says. “I would expect to see some dirt moving late 2016 and early 2017 based on current market conditions.”

CoStar is forecasting a gradual expansion of construction activity. In fact, 2016’s new supply is likely to be slightly below that of 2015 with the market expected to add 64.9 msf followed by 79.7 msf in 2017.